Continuing our experiments exploring how Gemini can help transform citizen participation in government, let's imagine you read in the news this afternoon that the US Senate rejected competing Democratic and Republican healthcare bills today. You see various policymaker, press and pundit discussions of different provisions and legalese, but want to understand for yourself how the two bills compare and what their core provisions are. Here we demonstrate using Gemini to get the bill numbers, Gemini 3 Pro to compare them in detail and Nano Banana Pro to create infographics detailing both bills and their comparisons, demonstrating how motivated citizens can already use these tools themselves to better understand the legislation their representatives are voting on.

Reading most of the media coverage today about the two bills, few mainstream articles cited the actual bill numbers or linked to their text, meaning we first needed to track down which bills were voted on today. Let's ask Gemini:

What are the bill numbers of the competing dem and rep healthcare bills that were voted on today?

This yielded the following results, which gave us our two bill numbers:

On Thursday, December 11, 2025, the U.S. Senate held competing votes on two major healthcare bills aimed at addressing the expiration of Affordable Care Act (ACA) premium tax credits.1 Both measures failed to clear the 60-vote threshold required to advance.2

🏛️ Competing Healthcare Bills

| Party | Bill Number | Bill Name | Key Provisions |

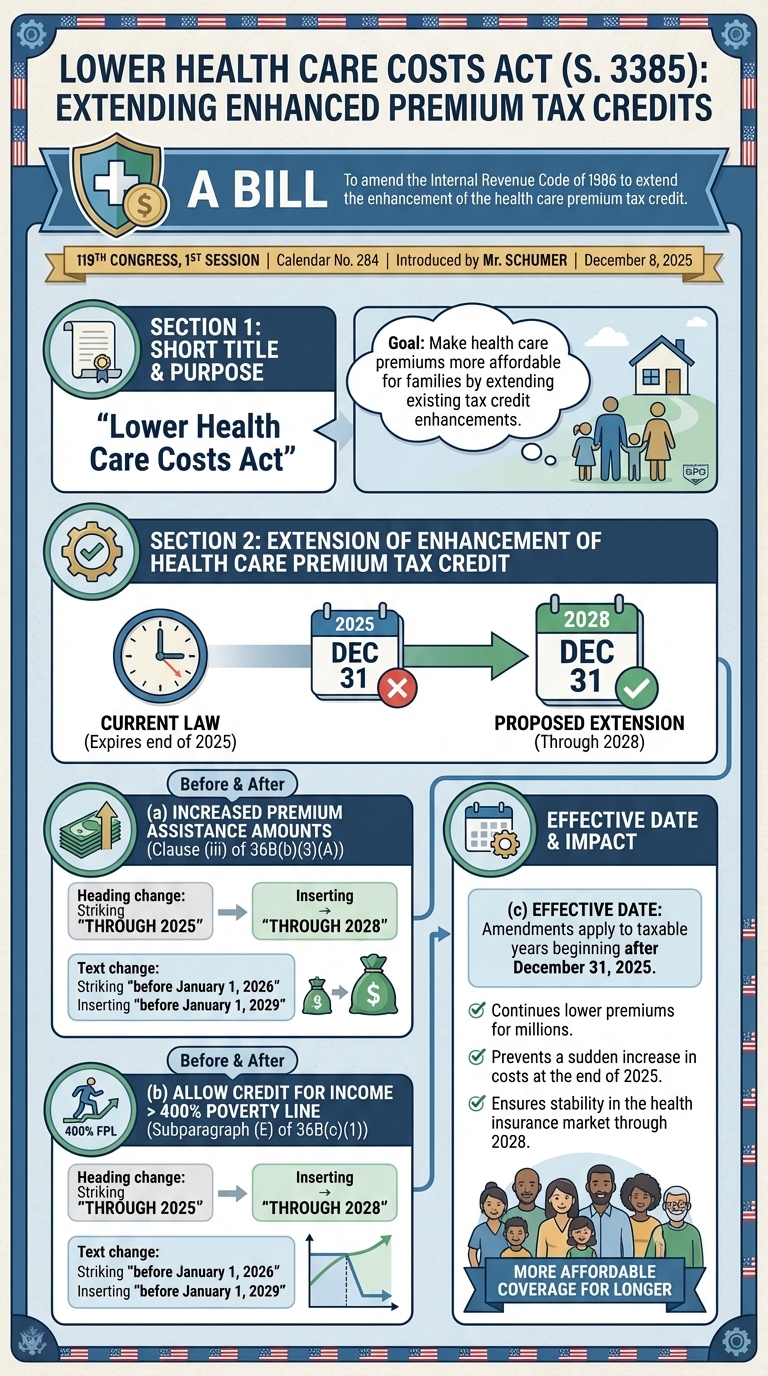

| Democratic | S. 3385 | Lower Health Care Costs Act | Would extend the enhanced ACA premium tax credits for three years (through 2028). |

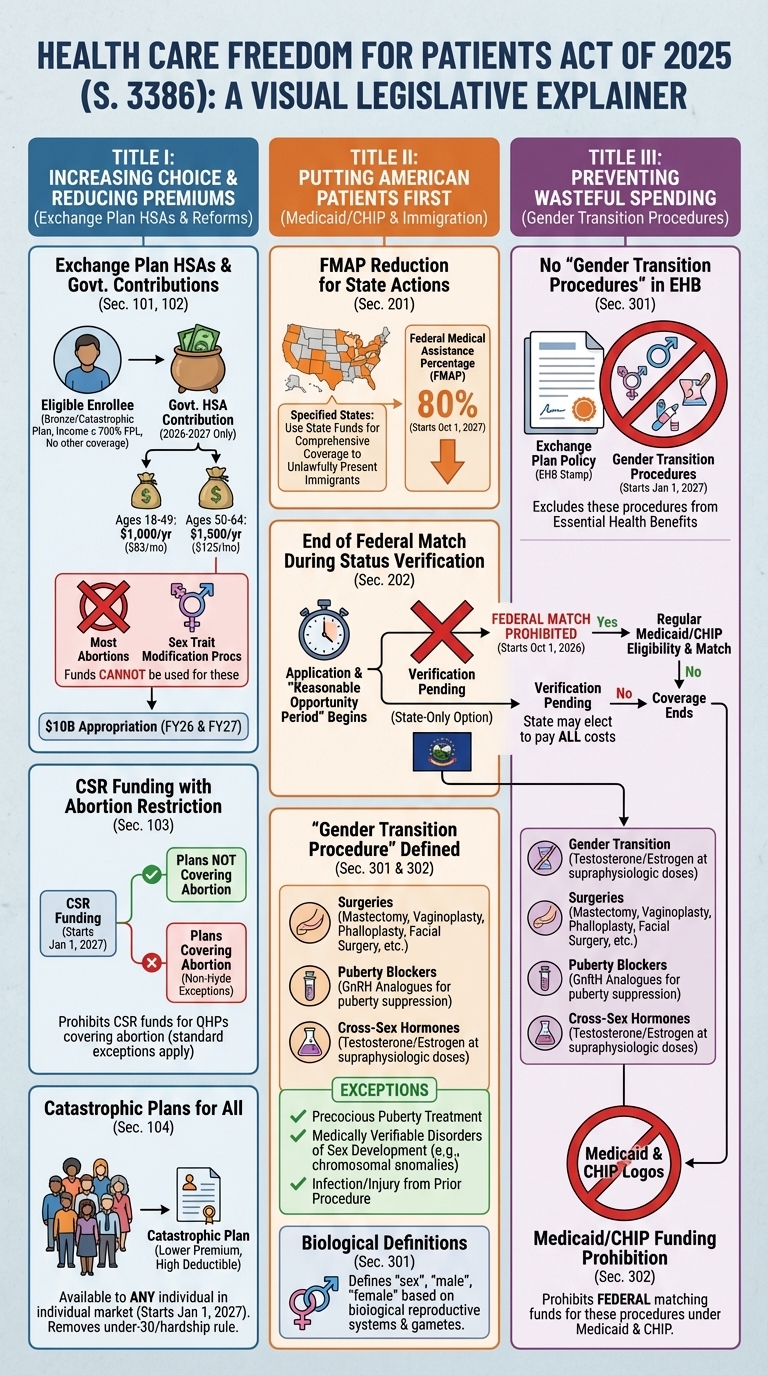

| Republican | S. 3386 | Health Care Freedom for Patients Act of 2025 | Would replace the credits with annual $1,000–$1,500 payments directly into Health Savings Accounts (HSAs) for certain enrollees. |

📉 Vote Outcomes

-

-

- Democratic Bill (S. 3385): Sponsored by Minority Leader Chuck Schumer, the motion to invoke cloture failed with a 51–48 vote. It received support from all Democrats and four Republicans (Sens. Susan Collins, Josh Hawley, Lisa Murkowski, and Dan Sullivan).

- Republican Bill (S. 3386): Sponsored by Senators Mike Crapo and Bill Cassidy, the motion to invoke cloture also failed with a 51–48 vote. While most Republicans supported it, Senator Rand Paul joined all Democrats in voting against the measure.

-

🔍 Background

These "side-by-side" votes were part of a deal reached to end a 43-day government shutdown earlier this year.5 With these failures, the enhanced subsidies are still currently set to expire on December 31, 2025, which nonpartisan analysts estimate could cause health insurance premiums to more than double for roughly 22 million Americans in the coming year.

Would you like more details on the specific vote tallies or the next steps for the ACA subsidies?

Armed with those two bill numbers, let's pull up their full text: S.3385 and S.3386.

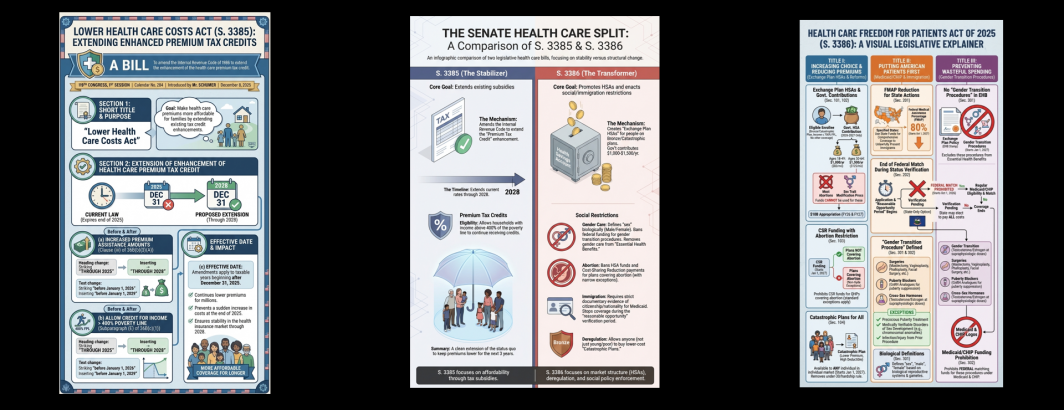

Now let's make an infographic of S.3385 by just dropping the bill PDF into Gemini 3 Pro and asking for a prompt and then rendering that prompt using Nano Banana Pro:

Create a prompt for a large illustrated explainer poster designed to be printed on a large-format poster printer and hung up on the wall that narrates the attached legislation as a single large poster that can be printed and hung on a wall that outlines all of the core details. Focus on the entire legislation.

And do the same for S.3386:

Of course, the real question is how the two bills differ, so let's upload the PDFs of both bills to Gemini 3 Pro and ask it to compare them:

Carefully compare these two bills. Give me a 1-2 page comparison of their main differences. Be detailed in your comparison.

This yields:

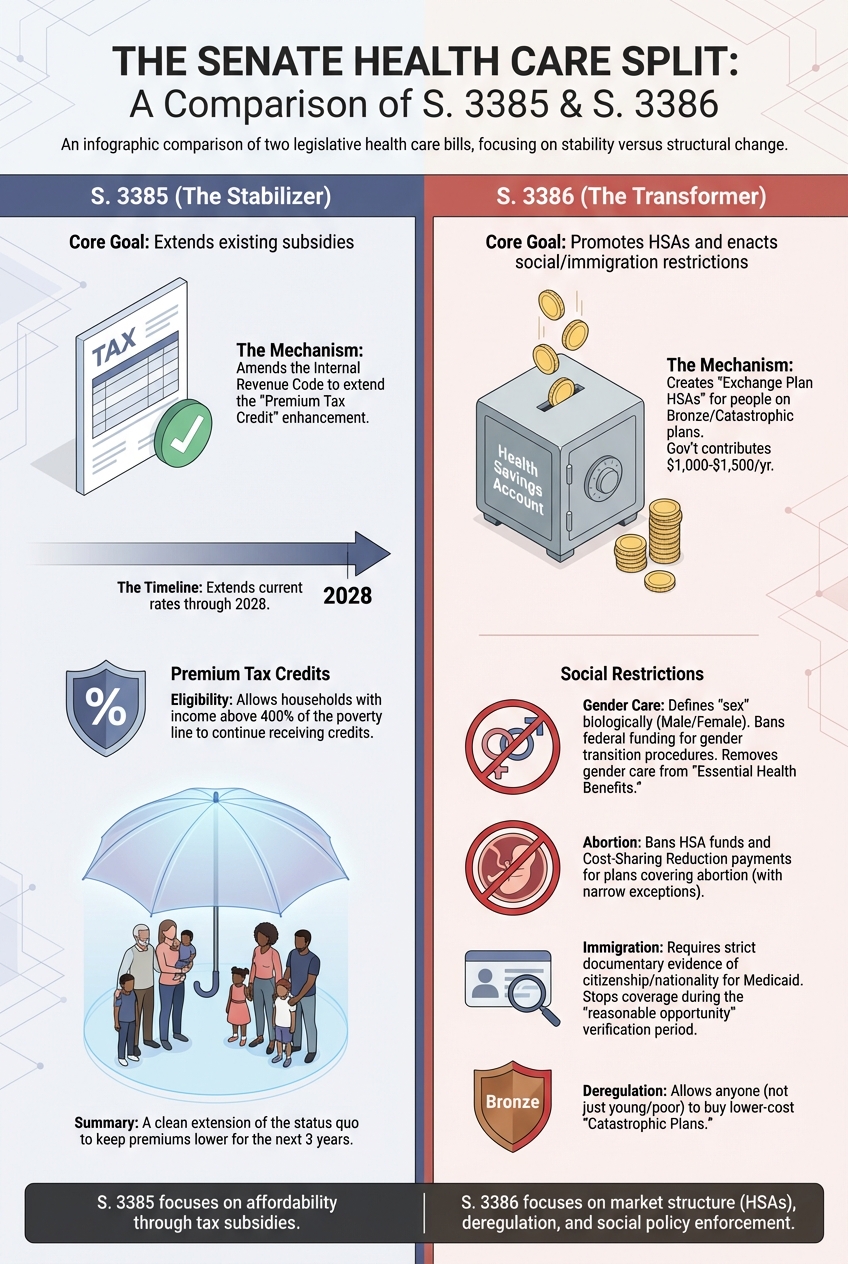

Based on a review of the provided documents, here is a detailed comparison of S. 3385 (Lower Health Care Costs Act) and S. 3386 (Health Care Freedom for Patients Act of 2025).

Executive Summary

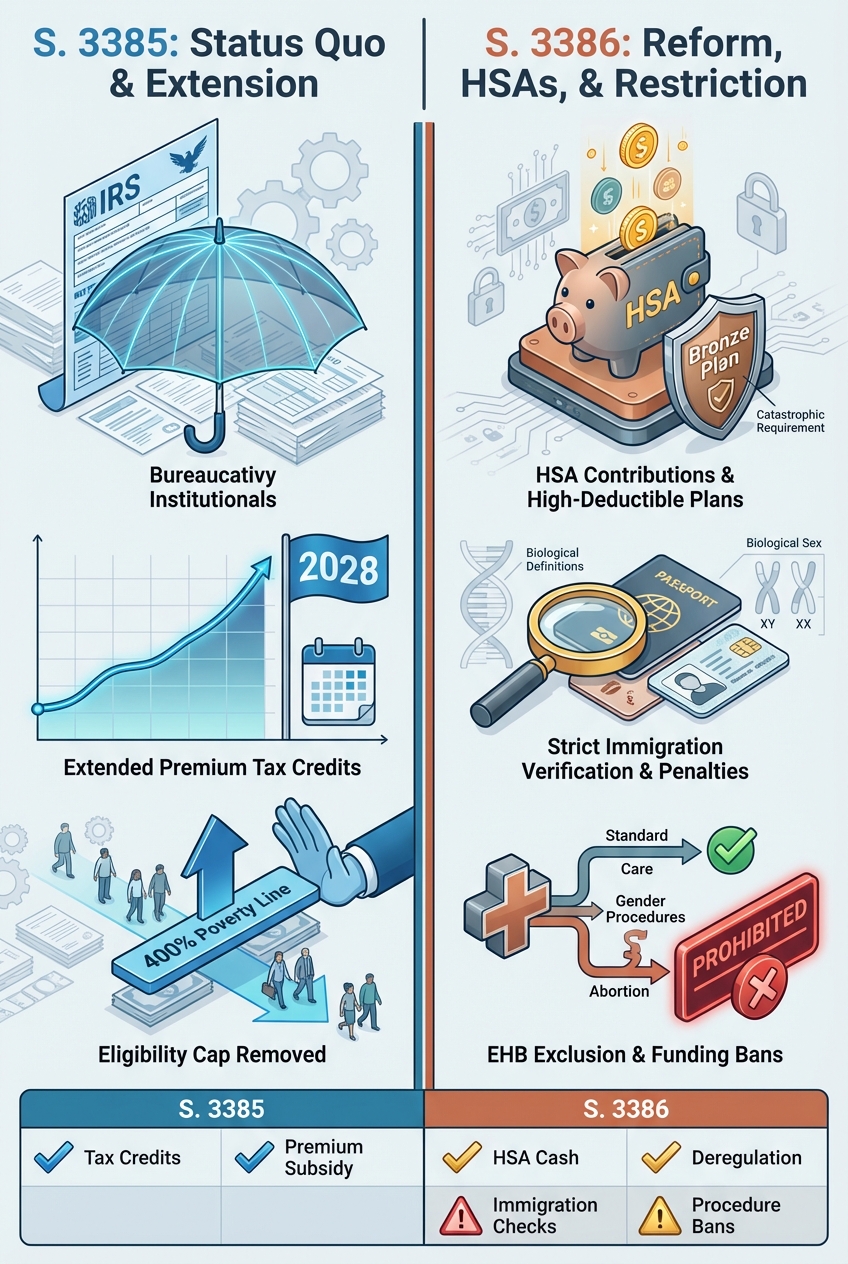

The two bills represent fundamentally different approaches to healthcare policy.

-

- S. 3385 is a narrow, targeted bill intended to maintain the status quo of the Affordable Care Act (ACA) by extending enhanced premium tax credits for three additional years. It focuses solely on affordability through existing subsidy mechanisms.

- S. 3386 is a comprehensive reform bill that shifts focus toward consumer-driven healthcare (Health Savings Accounts), deregulation (expanding catastrophic plans), and the implementation of strict social policy restrictions regarding immigration, abortion, and gender transition procedures.

Detailed Comparison of Key Provisions

1. Mechanism for Reducing Consumer Costs

-

- S. 3385 (Extension of Tax Credits):

- Approach: This bill focuses entirely on amending the Internal Revenue Code to extend temporary enhancements to the Premium Tax Credit.

- Subsidy Enhancement: It extends the more generous subsidy formulas (which lower the percentage of income people must pay for premiums) through 2028 (previously set to expire after 2025).

- Income Cap Removal: It extends the rule allowing households with incomes exceeding 400% of the federal poverty line to remain eligible for tax credits, provided the premiums cost more than a certain percentage of their income. This extension also runs through 2028.

- S. 3386 (HSAs and Plan Choice):

- Approach: This bill creates a new program called "Exchange Plan HSAs" and appropriates $10 billion annually (for 2026 and 2027) to fund it.

- Direct Contributions: The government would make direct payments into the HSAs of eligible enrollees. The amounts are

1,000/year∗∗forindividualsaged18–49and∗∗1,000/year** for individuals aged 18–49 and **1,500/year for those aged 50–64.

- Eligibility: To receive the contribution, individuals must enroll in a Bronze-level plan or a Catastrophic plan.

- Market Deregulation: The bill amends the ACA to allow all individuals to purchase "Catastrophic" plans. (Currently, these are restricted to those under 30 or those with hardship exemptions).

- S. 3385 (Extension of Tax Credits):

2. Social Policy: Abortion and Gender Transition

-

- S. 3385:

- Text: The bill is silent on these issues. It contains no new language regarding abortion or gender transition procedures.

- S. 3386:

- Abortion Restrictions:

- HSA Funds: The bill explicitly prohibits using the government-funded "Exchange Plan HSA" money for abortion services (with exceptions for rape, incest, or life of the mother).

- Cost-Sharing Reductions (CSR): While the bill appropriates funds for CSR payments starting in 2027, it bans these funds from being used for any qualified health plan that includes coverage of abortion (essentially applying the Hyde Amendment logic to insurance markets).

- Gender Transition Restrictions:

- Essential Health Benefits (EHB): The bill mandates that "gender transition procedures" cannot be considered Essential Health Benefits starting in 2027.

- Medicaid Ban: It prohibits Federal Medicaid and CHIP funding for "specified gender transition procedures."

- Definitions: The bill adds extensive text defining "gender transition procedure" (listing specific surgeries and hormone blockers) and defines "sex" strictly based on biological reproductive systems (producing eggs vs. sperm).

- Abortion Restrictions:

- S. 3385:

3. Medicaid and Immigration Policy

-

- S. 3385:

- Text: The bill does not address immigration status or Medicaid verification procedures.

- S. 3386:

- Funding Penalties: The bill reduces the Federal Medical Assistance Percentage (FMAP) to 80% for "Specified States." A state becomes "Specified" if it uses state general funds to provide non-emergency health coverage to undocumented immigrants.

- Strict Verification: It prohibits Federal Medicaid and CHIP matching funds for individuals whose citizenship or immigration status has not been verified.

- Removal of Grace Period: It removes the requirement (and restricts the option) for states to provide coverage during a "reasonable opportunity period" (usually 90 days) while an applicant is attempting to provide documentation of their citizenship or status. Coverage would be denied until verification is complete.

- S. 3385:

4. Cost-Sharing Reduction (CSR) Payments

-

- S. 3385:

- Does not address CSR payments.

- S. 3386:

- Appropriation: Section 103 formally appropriates "such sums as may be necessary" for CSR payments for plan years beginning after January 1, 2027. This addresses a long-standing legal ambiguity regarding CSR funding, but ties this funding to the abortion coverage prohibitions mentioned above.

- S. 3385:

Summary Table

| Feature | S. 3385 (Lower Health Care Costs Act) | S. 3386 (Health Care Freedom for Patients Act) |

| Primary Goal | Extend ACA Premium Tax Credits. | Promote HSAs, deregulate plans, restrict social spending. |

| Subsidy Duration | Extends enhancements through 2028. | Creates HSA payments for 2026–2027. |

| Assistance Type | Tax Credits (Premium reduction). | Direct Deposit (

1,500) into HSAs. |

| Plan Requirements | Applies to exchange plans generally. | Incentivizes Bronze/Catastrophic plans. |

| Catastrophic Plans | No change to eligibility. | Opens eligibility to all ages. |

| Abortion | No new restrictions. | Bans HSA/CSR funds for plans covering abortion. |

| Gender Transition | No mention. | Removes from Essential Health Benefits; bans Medicaid funding. |

| Immigration | No mention. | Penalizes states covering undocumented immigrants; strict ID verification required before coverage. |

| Sponsor | Mr. Schumer | Mr. Crapo (and Mr. Cassidy) |

Now let's visualize this analysis as an infographic:

Create a prompt for a large illustrated explainer poster designed to be printed on a large-format poster printer and hung up on the wall that narrates the analysis above as a single large poster that can be printed and hung on a wall that outlines all of the core details. Focus on the entire analysis.

That's a decent infographic, but not quite the caliber we've gotten thus far. Would asking Gemini to make the infographic from the start, instead of first making a textual report that is then turned into an infographic, yield better results? We get fairly similar results, though the results are slightly cleaner:

Carefully compare these two bills. Create a prompt for a large illustrated explainer poster designed to be printed on a large-format poster printer and hung up on the wall that narrates differences between the two bills as a single large poster that can be printed and hung on a wall that outlines all of the core details and differences. Make the poster a useful explainer for how the two bills are different.