Continuing our experiments from earlier today using Gemini 3 Flash to deeply analyze a day of television news coverage and explore the themes and trends underlying its coverage, let's apply the same approach to two channels from Syria, asking Gemini 3 Flash to "deeply analyze and reason about … the major themes, trends, developments, their importance and meaning and their implications for the present and future" of yesterday's coverage on Syrian News and Syria TV. As before, the goal here is not a bulleted list of what stories they covered, but rather having Gemini 3 sit there and "watch" the entire day's coverage (via reading the full-day Chirp ASR transcripts) on the two channels and think about the underlying themes and narratives and their implications. As always, the public Gemini 3 Flash API was used and no data was used to train or tune any model.

Let's start with Syrian News:

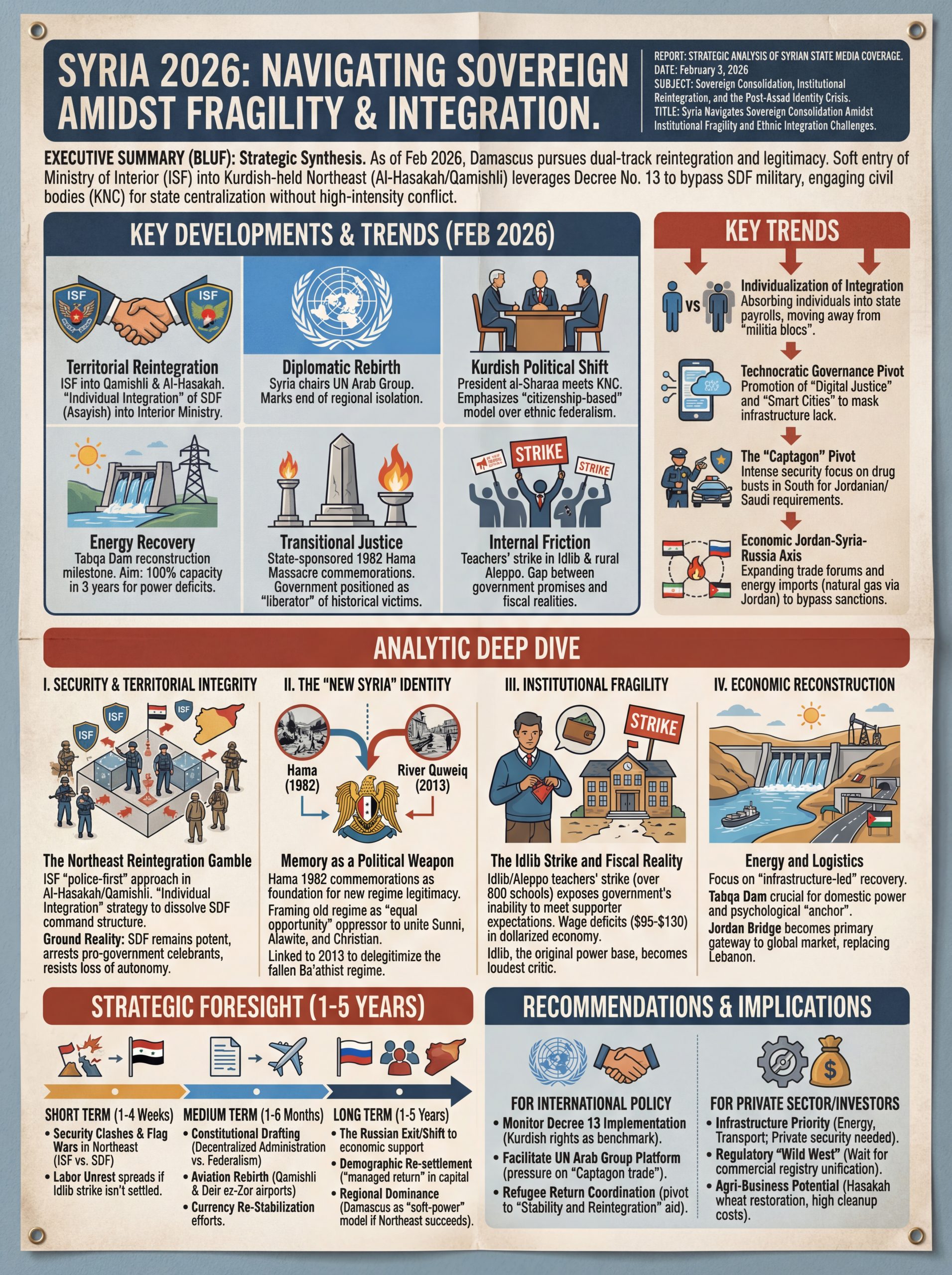

REPORT: STRATEGIC ANALYSIS OF SYRIAN STATE MEDIA COVERAGE

DATE: February 3, 2026

SUBJECT: Sovereign Consolidation, Institutional Reintegration, and the Post-Assad Identity Crisis

TITLE: Syria Navigates Sovereign Consolidation Amidst Institutional Fragility and Ethnic Integration Challenges.

EXECUTIVE SUMMARY (BLUF)

Strategic Synthesis:

As of February 2026, the transitional administration in Damascus, led by President Ahmad al-Sharaa, is aggressively pursuing a dual-track strategy of territorial reintegration and international legitimacy. The hallmark of the day’s coverage is the "soft entry" of Ministry of Interior forces into the Kurdish-held Northeast (Al-Hasakah and Qamishli). Damascus is leveraging Decree No. 13 (restoring Kurdish rights) as a diplomatic tool to bypass the military wing of the SDF (Qasd) while engaging directly with civil-political bodies like the Kurdish National Council (KNC). This is an attempt to transition Syria from a fragmented "militia-scape" into a centralized state without a high-intensity conflict.

However, the state narrative of "national joy" is contradicted by reports of SDF arrests of civilians celebrating the government's arrival and a burgeoning economic crisis in the administration’s original power base (Idlib), where a massive teachers' strike threatens social stability. The administration is using the 44th anniversary of the 1982 Hama Massacre to solidify a new national identity rooted in shared trauma and the total delegitimization of the fallen Ba'athist regime. While Syria’s assumption of the UN Arab Group chairmanship signals a return to the international fold, the internal reality remains one of "minus-zero" reconstruction, where infrastructure (Tabqa Dam, Deir ez-Zor Airport) is being salvaged rather than built.

Key Developments:

-

- Territorial Reintegration: Syrian Internal Security Forces (ISF) officially entered Qamishli and Al-Hasakah to begin the "individual integration" of SDF security elements (Asayish) into the Ministry of Interior.

- Diplomatic Rebirth: Syria assumed the presidency of the Arab Group at the UN in New York, marking the end of its decade-long regional isolation.

- Kurdish Political Shift: President al-Sharaa met with the Kurdish National Council (KNC) in Damascus, emphasizing a "citizenship-based" model over ethnic federalism.

- Energy Recovery: Reconstruction of the Tabqa (Euphrates) Dam reached a milestone, aiming for 100% capacity in three years to resolve chronic power deficits.

- Transitional Justice: Wide-scale state-sponsored commemorations of the 1982 Hama Massacre were held, positioning the current government as the "liberator" of historical victims.

- Internal Friction: A teachers' strike in Idlib and rural Aleppo entered a critical phase, highlighting the gap between government promises and fiscal realities.

Key Trends:

-

- Individualization of Integration: Moving away from negotiating with "militia blocs" to absorbing individuals into state payrolls.

- Technocratic Governance Pivot: Promotion of "Digital Justice" (electronic notifications) and "Smart Cities" (AI integration) to mask the lack of basic physical infrastructure.

- The "Captagon" Pivot: Intense security focus on drug busts in the South to satisfy Jordanian and Saudi security requirements.

- Economic Jordan-Syria-Russia Axis: Expanding trade forums to bypass the remnants of regional sanctions and secure energy imports (natural gas via Jordan).

ANALYTIC DEEP DIVE

I. Security & Territorial Integrity: The Northeast Reintegration Gamble

The deployment of the ISF into Al-Hasakah and Qamishli represents the most significant test of the "January 18 Agreement." Damascus is employing a "police-first" approach, avoiding the optics of a military invasion.

-

- Ground Reality vs. Narrative: While state media emphasizes "roses and rice" thrown at convoys, analysts note the SDF remains a potent parallel power. The ISF presence is currently restricted to "security squares" and specific administrative buildings. The reported arrests by the SDF of pro-government celebrants indicate that while the SDF leadership is negotiating, mid-level commanders remain hostile to the loss of autonomy.

- The Individual Integration Model: The Ministry of Interior’s insistence on "individual" rather than "unit" integration is a strategic move to dissolve the SDF's chain of command. By offering state salaries and legal status to Kurdish fighters as individuals, Damascus hopes to trigger a slow-motion collapse of the SDF as an organization.

II. The "New Syria" Identity: Memory as a Political Weapon

The 2026 commemorations of the Hama Massacre (1982) serve as the foundation for the new regime’s legitimacy.

-

- Historical Inversion: By officially mourning Hama—an event the Assad regime suppressed for four decades—the Sharaa administration is framing itself as a "restitutive" government. This appeals to the Sunni heartland but also signals to Alawites and Christians (through coverage of the Mar Georgios church destruction) that the old regime was an "equal opportunity" oppressor.

- Massacre Linkage: The media is deliberately linking 1982 to 2013 (River Quweiq massacre), creating a continuous 50-year narrative of "Asadist criminality." This prevents any nostalgia for the "stability" of the old regime during the current economic hardships.

III. Institutional Fragility: The Idlib Strike and Fiscal Reality

The teachers' strike in Idlib and Aleppo (over 800 schools) reveals the administration's primary vulnerability: the inability to meet the expectations of its own supporters.

-

- Wage Deficits: Salaries of 130 are unsustainable in a dollarized economy. The strike demonstrates that the "revolutionary" patience of the populace is exhausted.

- The Idlib Catch-22: The government’s original support base in Idlib is now its loudest critic. If the administration diverts funds from reconstruction to pay Idlib teachers, it risks stalling the integration of the East. If it does not, it faces an "internal revolution" in its cradle.

IV. Economic Reconstruction: Energy and Logistics

The focus on the Tabqa Dam and Deir ez-Zor airport highlights the shift toward an "infrastructure-led" recovery.

-

- The Energy Crisis: Currently, Al-Hasakah relies on "amperes" (private generators), a high-cost, inefficient system. The reintegration of the oil fields (Rumailan, Al-Omar) is critical not just for exports, but for domestic power. The claim that Tabqa can provide 1/3 of Syria’s power is technically optimistic but serves as a vital psychological "anchor" for a frustrated population.

- The Jordan Bridge: The economic forum in Amman and the gas deal indicate that Jordan has become Syria’s primary gateway to the global market, replacing Lebanon’s failed financial sector.

STRATEGIC FORESIGHT

Short Term (Tactical | 1-4 Weeks):

-

- Security Clashes: Expect localized "blue-on-green" friction in Hasakah between the ISF and SDF elements who refuse the integration terms.

- Flag Wars: The issue of which flag flies over administrative buildings in the Northeast will likely spark small-scale riots or arrests, testing the ISF’s "strategic patience."

- Labor Unrest: If the Idlib teachers' strike is not settled with a one-time "stability grant," it will likely spread to the health sector and civil servants in Damascus.

Medium Term (Operational | 1-6 Months):

-

- Constitutional Drafting: The meeting with the KNC suggests that a formal constitutional drafting process will begin soon. This will likely focus on "Decentralized Administration" (Law No. 107 style) to appease Kurds without granting "Federalism."

- Aviation Rebirth: The re-opening of the Qamishli and Deir ez-Zor airports will facilitate "sovereignty flights," physically re-linking the periphery to the capital.

- Currency Re-Stablization: The Central Bank's 90-day window for currency exchange suggests a move toward a new "post-war" Lira or a more formalized bimetallic/dollarized system to curb inflation.

Long Term (Strategic | 1-5 Years):

-

- The Russian Exit/Shift: While Russia remains a "guarantor," their shift toward "economic support" rather than "military protection" indicates a desire to transition their Syrian presence into a profitable commercial venture (construction, mining, health).

- Demographic Re-settlement: Plans for Jobar and Qaboun suggest a "managed return" where property rights will be used to filter returnees, ensuring a loyalist or "vetted" population in the capital's beltway.

- Regional Dominance: If Damascus successfully manages the Northeast without war, it will emerge as a regional model for "soft-power" counter-insurgency, likely gaining further investment from the GCC (Saudi/UAE).

RECOMMENDATIONS & IMPLICATIONS

For International Policy:

-

- Monitor Decree 13 Implementation: The international community should treat the citizenship and cultural rights of Kurds as a benchmark for Syria’s human rights compliance. Support should be contingent on these rights moving from "Decree" to "Constitution."

- Facilitate the UN Arab Group Platform: Use Syria’s new role at the UN to force a definitive stance on the "Captagon trade." If Damascus wants to lead the Arab Group, it must show measurable success in dismantling the remaining southern smuggling networks mentioned in the drug busts.

- Refugee Return Coordination: With reports of thousands returning from Germany and Turkey, international NGOs must pivot from "Cross-Border" aid to "Stability and Reintegration" aid inside Syria, specifically targeting infrastructure in the newly integrated East.

For Private Sector/Investors:

-

- Infrastructure Priority: Opportunities are highest in the energy and transport sectors (Tabqa Dam, Railway restoration). However, the "individual integration" of SDF forces suggests that local security remains fragmented; private security for logistics remains a necessary cost.

- Regulatory "Wild West": The transition from SDF "Management" to State "Ministry" in the East will create a period of dual-taxation and legal ambiguity regarding oil and grain contracts. Investors should wait for the "unification of the commercial registry" before finalizing large-scale commitments.

- Agri-Business Potential: With the "breadbasket" (Hasakah) returning to state control, there is significant room for investment in modern irrigation and seeds to restore the 55% of wheat production lost during the war. However, the "minus-zero" state of the soil due to primitive oil extraction means high initial environmental cleanup costs.

END OF REPORT

We'll also ask Nano Banana Pro to turn this analysis into an infographic:

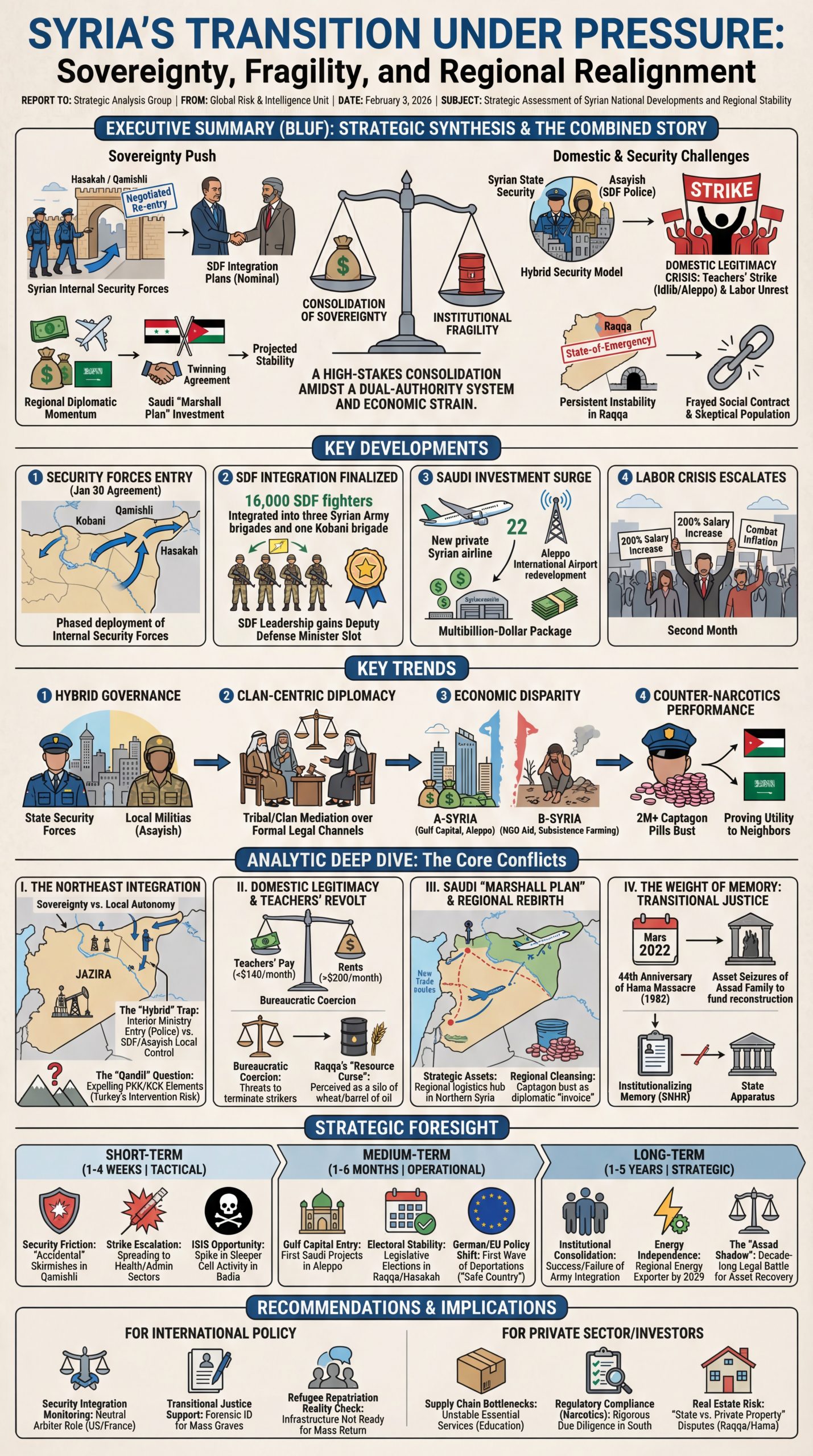

Now let's repeat for Syria TV:

DATE: February 3, 2026

SUBJECT: Strategic Assessment of Syrian National Developments and Regional Stability

TITLE: A Transition Under Pressure: Syria Reclaims the North Amidst Institutional Fragility and Regional Realignment

EXECUTIVE SUMMARY (BLUF)

Strategic Synthesis:

As of February 2026, the Syrian transitional administration under President Ahmed al-Sharaa is navigating a high-stakes consolidation of sovereignty, primarily characterized by the negotiated re-entry of state institutions into Kurdish-administered territories. While the peaceful entry of Internal Security Forces into Hasakah and Qamishli represents a major symbolic win for national unity, the ground reality is a "hybrid security" model fraught with friction. The Syrian Democratic Forces (SDF) and their internal security arm (Asayish) are nominally integrating but remain a distinct power center, evidenced by the arrest and intimidation of civilians welcoming state forces. This duality threatens to create a "frozen conflict" within the state apparatus.

Concurrently, the administration is leveraging significant regional diplomatic momentum—notably a projected multibillion-dollar Saudi investment package and a "twinning" agreement with Jordan—to mitigate a brewing domestic legitimacy crisis. This crisis is manifested in widespread labor unrest, specifically a massive teachers’ strike in Northern Syria, and the persistent "state-of-emergency" conditions in Raqqa. The government's survival depends on its ability to transform high-level diplomatic successes and "Marshall Plan" style investment promises into tangible service delivery for a population that remains skeptical of centralized authority.

Key Developments:

-

- Security Forces Entry: Syrian Internal Security Forces began a phased deployment into Hasakah, Qamishli, and the rural environs of Kobani (Ayn al-Arab) following the January 30 agreement.

- SDF Integration: Plans are finalized to integrate 16,000 SDF fighters into three Syrian Army brigades and one brigade in Kobani, with SDF leadership gaining a Deputy Defense Minister slot.

- Saudi Investment Surge: Announcement of massive Saudi investment in a new private Syrian airline, telecommunications, and the redevelopment of Aleppo International Airport.

- Labor Crisis: A massive strike by teachers in Idlib and rural Aleppo enters its second month, with educators demanding a 200% salary increase to combat inflation.

- Transitional Justice: The 44th anniversary of the 1982 Hama Massacre is commemorated officially for the first time following the death of Rifaat al-Assad, intensifying calls for asset seizures.

- Israeli Incursion: Continued IDF "scorched earth" operations along the Qunitra/Daraa border, despite a U.S.-mediated "deconfliction mechanism."

Key Trends:

-

- Hybrid Governance: The emergence of a "dual-authority" system where state security forces and local militias (Asayish) co-exist in the same urban spaces.

- Clan-Centric Diplomacy: The government increasingly uses tribal/clan mediation to resolve local disputes (e.g., body exchanges in Raqqa) rather than formal legal channels.

- Economic Disparity: A widening gap between the "A-Syria" (attracting Gulf capital) and "B-Syria" (dependent on dwindling NGO aid and subsistence farming).

- Counter-Narcotics Performance: Proactive "showcase" drug busts (2M+ Captagon pills) to prove the new state’s utility to its neighbors (Jordan/KSA).

ANALYTIC DEEP DIVE

I. The Northeast Integration: Sovereignty vs. Local Autonomy

The deployment of Syrian Internal Security Forces into the "Island" (Jazira) region is the most significant test of the transitional government to date. The agreement with the SDF is a masterpiece of pragmatic compromise, yet the transcripts reveal deep-seated mistrust.

-

- The "Hybrid" Trap: In Hasakah and Qamishli, the state is entering via the "Interior Ministry" (police) rather than the "Defense Ministry" (army). This is a strategic choice to project stability over conquest. However, the Asayish (SDF police) are still making arrests, specifically targeting those who showed "excessive" enthusiasm for the state’s arrival. This indicates that while the SDF has surrendered the narrative of independence, it has not surrendered the mechanics of local control.

- The "Qandil" Question: The Interior Ministry’s demand to expel "foreign fighters" (PKK/KCK elements) is the primary hurdle. If the "Qandil wing" of the SDF remains embedded, Turkey’s "vocal support" for the agreement will likely shift back to military intervention.

- Economic Integration: The reactivation of oil wells in Hasakah is being framed as a benefit for locals (job creation), but the centralization of oil revenues in Damascus remains a point of friction for the local Kurdish population who fear a return to Ba'ath-era "economic marginalization."

II. Domestic Legitimacy and the "Teachers' Revolt"

While the government focuses on high-level geopolitics, the social contract is fraying in the Northwest (Idlib/Aleppo).

-

- The Salary Impasse: Teachers, who were the backbone of the "Free Education" movement during the revolution, now find themselves earning less than $140/month in a region where rents exceed $200.

- Bureaucratic Coercion: The government’s response—threatening to terminate strikers and replace them with "administrative" staff or pressuring NGOs to cut supplementary pay—mirrors the authoritarian tactics of the previous regime. This is radicalizing a demographic (educators) that the Sharaa administration needs as partners for national "de-Ba'athification" and modernization.

- Raqqa's "Resource Curse": In Raqqa, locals express a profound sense of being viewed as a "silo of wheat and a barrel of oil." The transition there is hampered by the massive infrastructure of tunnels left by ISIS and the SDF, and a perceived lack of civilian/professional representation in the new administration in favor of tribal elders.

III. The Saudi "Marshall Plan" and Regional Rebirth

The news of Saudi Arabia’s multi-billion dollar investment is the administration's primary shield against domestic criticism.

-

- Strategic Assets: Developing a new private airline with 22 aircraft and rehabilitating Aleppo Airport suggests a shift toward making Northern Syria a regional logistics hub.

- Regional Cleansing: The massive Captagon bust in the South is not a routine police action; it is a diplomatic "invoice" sent to Jordan and Saudi Arabia, proving that the new government is a reliable partner in the "War on Drugs"—a prerequisite for the lifting of remaining international sanctions.

- Syria-Lebanon Demarcation: The announcement that border demarcation will begin "soon" is a landmark development. For decades, the Assad regime used an undefined border to facilitate smuggling and political interference. A defined border signals Syria’s transition from a "revolutionary cause" to a "sovereign nation-state."

IV. The Weight of Memory: Transitional Justice

The 44th anniversary of the Hama Massacre, coupled with the recent death of the "Butcher of Hama," Rifaat al-Assad, has forced the government to confront the past.

-

- Institutionalizing Memory: Calls by the Syrian Network for Human Rights (SNHR) to make February 2nd a National Day of Remembrance and to establish a local agency to find 17,000 missing persons in Hama put the Sharaa government in a difficult position. It must satisfy the demand for justice without alienating segments of the old state apparatus that are necessary for the current transition.

- The "Assad Asset" Demand: There is a growing popular movement to seize the global assets of the Assad family to fund the national reconstruction of Hama and Raqqa.

STRATEGIC FORESIGHT

Short-Term (Tactical | 1-4 Weeks):

-

- Security Friction: Expect "accidental" skirmishes in Qamishli between Asayish and Syrian Internal Security as they navigate joint patrols.

- Strike Escalation: If the government does not offer a significant "inflation bonus" to teachers by mid-February, the strike will likely spread to the health sector and administrative civil servants in Idlib.

- ISIS Opportunity: The transfer of 7,000 ISIS detainees to Iraq creates a temporary security vacuum. Expect a spike in "sleeper cell" activity in the Badia (desert) as a test of the new Army/SDF integration.

Medium-Term (Operational | 1-6 Months):

-

- Gulf Capital Entry: The first Saudi-funded projects in Aleppo will begin. This will cause a localized economic boom in Aleppo but may exacerbate resentment in Daraa and Raqqa if investment is not "balanced."

- Electoral Stability: The "High Committee for Elections" will attempt to hold legislative elections in Raqqa and Hasakah. Success here will signal the first real post-Assad democratic exercise in the East.

- German/EU Policy Shift: Following the ruling in Cologne, Germany will likely begin the first wave of deportations of "criminal" or "non-integrated" Syrians, using the "Safe Country" designation as a diplomatic lever with Damascus.

Long-Term (Strategic | 1-5 Years):

-

- Institutional Consolidation: The success or failure of the "Army Integration" of the SDF will determine if Syria remains a unified state or a collection of de-facto autonomous zones.

- Energy Independence: If the Jazira oil fields are successfully integrated and modernized via foreign investment, Syria could move from an aid-dependent state to a regional energy exporter by 2029.

- The "Assad Shadow": The legal battle for the recovery of Assad family assets will be a decade-long process, serving as a primary driver of Syrian foreign policy toward the UK, France, and Spain.

RECOMMENDATIONS & IMPLICATIONS

For International Policy:

-

- Security Integration Monitoring: The international community (specifically the U.S. and France) must act as a neutral arbiter in the integration of the SDF. Failure to do so will result in a "shadow militia" structure that will eventually destabilize the central government.

- Transitional Justice Support: Provide technical assistance for forensic identification of mass graves in Hama and Raqqa to prevent "revenge justice" from tribal entities.

- Refugee Repatriation Reality Check: While Germany is moving toward a "Safe Country" status, the reality of the teachers' strike and Raqqa’s "emergency status" suggests that the infrastructure for a mass return of 6 million refugees does not yet exist.

For Private Sector/Investors:

-

- Supply Chain Bottlenecks: While the Saudi "Marshall Plan" is promising, the Northwest teachers' strike indicates that essential services (education, child care) are unstable. This could impact the availability of skilled labor in the medium term.

- Regulatory Compliance (Narcotics): Investors must perform rigorous due diligence on any logistics or transport firms in the South (Daraa/Suwayda), as the drug trade remains deeply embedded despite government crackdowns.

- Real Estate Risk: In Raqqa and Hama, the "State Property vs. Private Property" dispute is at a fever pitch. Assets built over the ruins of destroyed neighborhoods face significant legal challenges and possible future expropriation by the Commission for Restorative Justice.

End of Report

And as an infographic: