The research staff at Banco Bilbao Vizcaya Argentaria (BBVA)’s Cross-Country Emerging Markets Unit have produced another series of captivating risk visuals, this time of as part of a working paper titled "An Empirical Assessment of Social Unrest Dynamics and State Response In Eurasian Countries". The abstract is reproduced below:

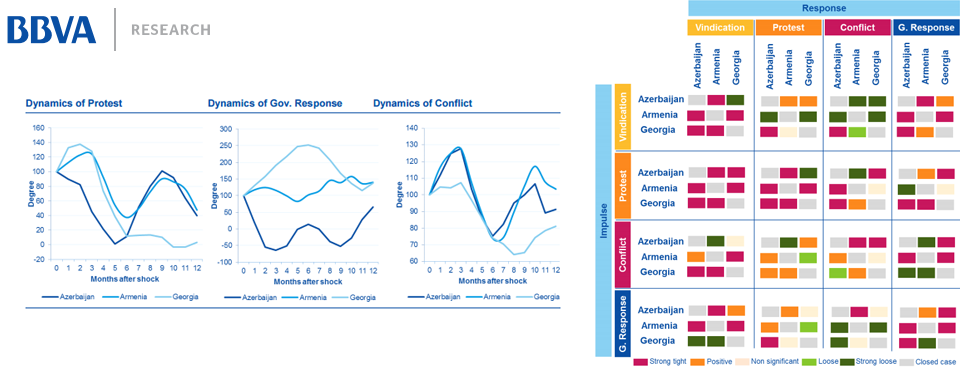

This paper shows an empirical assessment of Social Unrest Dynamics in the Eurasian countries. We use a Big Database of social events (GDELT) to build several real time indexes of different stages of social unrest escalation consistent with the Unrest Lifecycle Theory and together with alternative measures of the state response. We build a Vector Autoregressive (VAR) model to analyse the Unrest Dynamic Cycle of social agents and the state response. Our results show that Eurasia is a fairly volatile region in terms of the size of social shocks and its responses, similarly to other regions such as MENA. While Social responses are relevant and stronger at the initial stages of unrest, they decay rapidly as the intensity of shocks increases. This is partially the result of an adaptive behaviour of the sate response (from coercion at the early stages of the unrest cycle to cooperation when instability escalates). This state response is consistent with the standard U-shaped relation between repression and conflict, frequently found in the literature Social Unrest and State action are not homogenous across the Eurasian region. In fact, as we move to the West and Central Eurasia, population is more prone to conflict escalation and the enforcing ability of the State is lower as the backlash theory (U-Shaped) explains. We also find traces of spill over-effects or contagion of social unrest between the population and to a lesser extent between State responses, among countries who share boundaries.