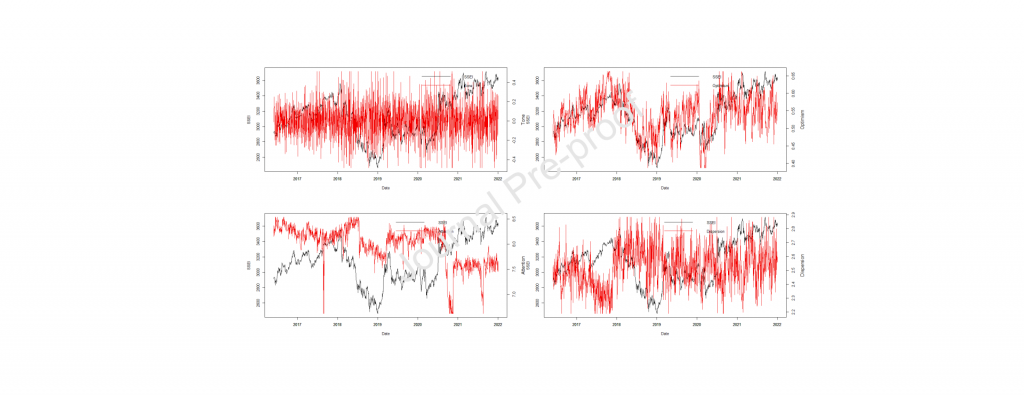

We construct and assess new time series measures of news media sentiment based on Global Data on Events, Location, and Tone (GDELT) using Data Science techniques. Five sentiment measures representing the news media Tone, Optimism, Attention, Tone Dispersion, and Emotional Polarity of Chinese stock markets are constructed based on article tone scores and media coverages from GDELT. All these news media sentiment measures are shown to have significant predictive power for Chinese stock market returns and volatilities. We also document substantial asymmetric sentiment effects on the Chinese stock market returns and volatilities. Sentiment extended EGARCH models are shown to improve market return and volatility forecasting accuracy significantly.

Measuring News Media Sentiment Using Big Data For Chinese Stock Markets