This fascinating paper in the Journal of International Money and Finance by researchers at the European Commission's Joint Research Centre and Cà Foscari University examines sentiment analysis applied to economic indicators:

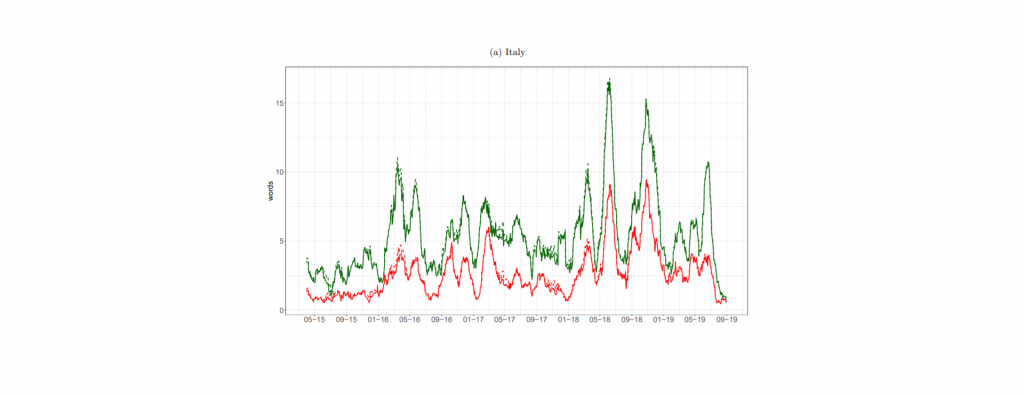

We show how emotions extracted from macroeconomic news can be used to explain and forecast future behaviour of sovereign bond yield spreads in Italy and Spain. We use a big, open-source, database known as Global Database of Events, Language and Tone to construct emotion indicators of bond market affective states. We find that negative emotions extracted from news improve the forecasting power of government yield spread models during distressed periods even after controlling for the number of negative words present in the text. In addition, stronger negative emotions, such as panic, reveal useful information for predicting changes in spread at the short-term horizon, while milder emotions, such as distress, are useful at longer time horizons. Emotions generated by the Italian political turmoil propagate to the Spanish news affecting this neighbourhood market.